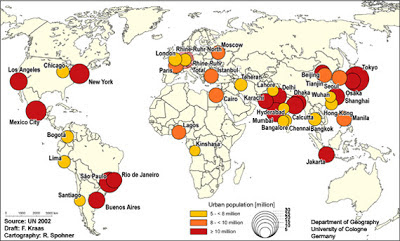

Emerging economies to double population by 2030

Developing countries are urbanizing fast. To meet the challenges that creates, city leaders must move quickly to plan, connect, and finance resilient and

Developing countries are urbanizing fast. To meet the challenges that creates, city leaders must move quickly to plan, connect, and finance resilient and sustainable growth. A new World Bank report provides a framework to help.

Today’s developed countries urbanized mostly gradually, their cities expanding over a period of 100 years or more as jobs shifted from farms to factories.

The pace allowed for trial and error in growth patterns and policies. Developing countries today don’t have that luxury. They’re facing rapid migration that will tilt some populations from less than 20 percent urban today to more than 60 percent in just 30 years.

City leaders must figure out now how they will provide the affordable homes, transportation, jobs, and basic infrastructure and services necessary to support already ballooning urban populations, do so with the least impact on the environment and prepare for increasing vulnerabilities stemming from climate change.

A new World Bank report, Planning, Connecting and Financing-Now: What City Leaders Need to Know, provides a framework for urban growth planning and finance, backed by case studies, to help leaders identify the impediments to urbanization and find the right combinations of policy options that would work politically, technically, and fiscally for their cities and countries. It helps them think through questions such as, What must be done to create jobs and expand basic services? What must be done to improve living conditions in slums and hazard-prone areas? What must be done to manage the city’s physical form?

“City leaders at all levels must start now with careful land use planning that looks well into the future for the sake of their city’s economy, equity, and sustainability. How they prepare for rapid urbanization matters not only to the future of their cities but to global economic progress,” said report author Somik Lall, lead urban economist at the World Bank.

The report’s urban development framework is based on three dimensions:

Planning — charting a course for cities by setting the terms of urbanization, particularly policies for using urban land and expanding basic infrastructure

and public services.

Connecting — making a city’s labor, goods, and services available across the city and to other cities and export markets.

Financing — finding the up-front capital to provide infrastructure and services as urbanization picks up speed.

Planning & Connecting

Of the three, the authors write, planning for land use and basic services is the most critical to cities growing efficiently, cleanly, and inclusively and to avoiding locking in detrimental development patterns.

Once built, urban infrastructure will determine how a city’s land can be used in the future. Aligning land use and infrastructure can also help promote inclusion and manage the formation and growth of slums. In Tunisia, a national upgrading program reduced slum housing from 23 percent in 1975 to 2 percent in 1995 of the overall housing stock. National utilities helped make the program a success through large investments in water and sewer infrastructure that upgraded informal settlements.

Financing

The upfront costs of infrastructure will always be an issue for cities. Building mass transportation, water treatment, and waste management systems far

exceed most cities’ budgets.

To help finance investments in infrastructure, the report details three main tasks for city leaders:

Value and develop the city’s creditworthiness. Creditworthiness can be demonstrated by securing cash flows through user fees and taxes—and, where necessary, by raising revenue through leveraged assets. It is also possible to tap capital markets, either by issuing bonds or by borrowing from specialized financial institutions and intermediaries.

Coordinate public and private finance using clear and consistent rules. With enough assurance that commitments are firm, public-private partnerships can reduce the fiscal burden of infrastructure improvement projects.

Leverage existing assets to develop new ones, linking both to land use planning. Leveraging can include land and property taxes, land sales and leases, charges for impact and development, betterment levies, and tax-increment financing.

Many city governments in developing countries cannot access long-term credit because they lack domestic credit markets and transparency in municipal bond markets. Private investors can help fill the gap, such as through service contracts, management contracts, leases, and privatization. In the long run, though, governments must tap revenues, such as property taxes, or similar levies, and access long-term credit, to fund the maintenance and expansion of public facilities, the authors write.

Urbanization Reviews

The recommendations and case studies in the report are drawn, in part, from a series of urbanization reviews conducted by the World Bank. Included are lesson from reviews in seven countries – Brazil, China, Colombia, India, Indonesia, Korea, and Vietnam – touching on issues including land ownership, housing supplies, transportation costs, and providing basic services.

By fostering a concentration of people and economic activities in small areas with policies that promote inclusion, sustainability, and connections, cities can transform economies, enabling social and economic interactions and creating a vibrant market for ideas that translates into innovations by entrepreneurs and investors. (The World Bank)

Comments